Hard Money Atlanta Can Be Fun For Everyone

Wiki Article

Everything about Hard Money Atlanta

Table of ContentsThe Best Strategy To Use For Hard Money Atlanta8 Simple Techniques For Hard Money Atlanta5 Easy Facts About Hard Money Atlanta ShownSee This Report on Hard Money AtlantaSome Known Details About Hard Money Atlanta 6 Easy Facts About Hard Money Atlanta DescribedSome Of Hard Money Atlanta10 Simple Techniques For Hard Money Atlanta

Go To Capitalist Funding Resource for more information, or follow them on Connected, In, Facebook, and Twitter. Published in Exactly How To Retire Well Self Directed IRAs. This device figures monthly repayments on a tough money financing, offering repayment quantities for P&I, Interest-Only and Balloon payments in addition to providing a regular monthly amortization timetable. This calculator instantly figures the balloon repayment based upon the gotten in finance amortization duration. If you make interest-only repayments after that your monthly settlements will be the interest-only settlement quantity listed below with the balloon settlement being the original quantity borrowed.While financial institutions as well as cooperative credit union supply business lendings, not everyone can access them. Standard commercial home loans impose strict underwriting treatments that take a long period of time to obtain accepted (3 months or even more). They need high credit history as well as proof that your business has adequate capital to repay the home mortgage.

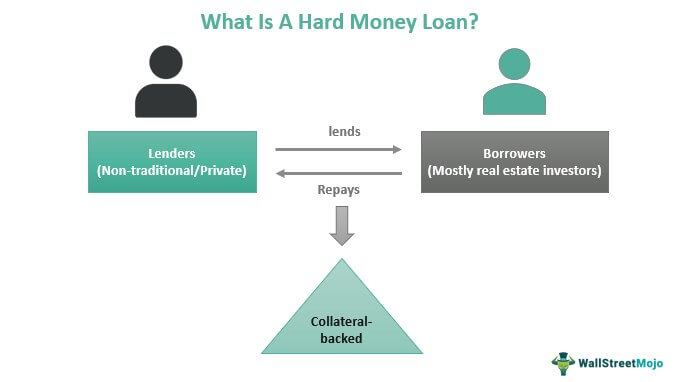

If you can not protect a typical industrial finance, you can count on hard cash loan providers. These are private investors who provide financing based upon the property you are using as collateral. Just how do they function? In this write-up, we'll chat regarding hard cash financing needs, its repayment framework, and also rates.

The Facts About Hard Money Atlanta Revealed

What are Hard Cash Fundings? Unlike business fundings from banks, tough cash fundings are based on home being used as security rather than the borrower's credit reliability.This is often considered the last option if you are unqualified for conventional business funding. Economic professionals say difficult refers to the nature of the car loan, which is challenging to finance by conventional requirements. Others state it refers to the collateral of the finance being a difficult property, which is the real estate residential or commercial property protecting the lending.

Lenders also anticipate regular monthly interest-only repayments and also a balloon repayment at the end of the finance. The range is normally between 6% as well as 10% for bridge lendings, while hard money loans range from 10% to 18%.

What Does Hard Money Atlanta Mean?

You can safeguard it also if you have a history of foreclosure. The building is authorized as security, which is the only defense a loan provider depends on in instance you back-pedal your financing. Hard cash lending institutions largely establish loan authorization and also terms based upon the building utilized as collateral.

As for deposit, 20 percent to 30 percent of the car loan amount is called for. Some hard cash suppliers may need 10 percent down settlement if you are a skilled house flipper. Expect a Reduced Loan-to-Value Ratio Most tough money lenders comply with a lower loan-to-value (LTV) proportion, which is 60 percent to 80 percent.

The reduced LTV suggests hard money lending institutions do not supply as much financing as standard business sources. If you skip on your funding, a loan provider can depend on marketing your residential property swiftly. They may additionally have greater opportunities of recovering the shed funds. On the various other hand, get ready for several drawbacks.

The Best Guide To Hard Money Atlanta

Hard cash fundings have a price of 10 percent to 18 percent. Traditional business finances normally visit here have rates between 1. 176 percent to 12 percent. In this respect, tough cash car loan rates can be better than subprime industrial car loans. The increased expense is a sign of the high danger loan providers encounter when they supply this sort of funding.To give you an instance, let's state you obtained a tough money pop over to this site financing at $800,000 with 12 percent APR.

The 10-Second Trick For Hard Money Atlanta

Using the calculator above our page, allow's approximate your month-to-month interest-only payment, principal as well as passion settlement, and overall balloon settlement. Settlement Type, Amount Interest-only repayment$8,000. hard money atlanta.

In various other circumstances, a genuine estate bargain may not pass strict standards from a typical lender. For these factors, residence flippers turn to tough cash finances.

Hard Money Atlanta Things To Know Before You Get This

Once they buy a residence, they remodel it until it is all set for sale. This typically takes a pair of months to a year, making it excellent for temporary financing. Once they have the ability to make a sale, they can pay back the lending. On the various other hand, if a home fin defaults, the hard cash lending institution can foreclose or take possession of the building.The bargain turns out, it can still be a rewarding end result for the loan provider. Debtors who have a tough time safeguarding a typical business financing might take hard money funding. Prior to you sign any type of bargain, you need to evaluate in the benefits and downsides of taking this type of loan.

In other cases, when it pertains to skilled home fins, lenders link permit the passion to build up. A residence fin can pay the rate of interest in addition to the continuing to be equilibrium up until the term is with. Hard money loan providers may also not be as vital with settlement. This is the situation if your lender discovers a great chance to make revenues from your residential or commercial property.

Getting My Hard Money Atlanta To Work

Greater rate of interest is a major drawback for tough money financings. This can be 4 to 10 portion points greater than typical industrial mortgages. The high passion price additionally translates to greater monthly payments. Overall, it sets you back greater than standard commercial finances. The short-term likewise offers you much less time to produce revenue.If you can not pay the remaining balance on time, you need to re-finance to a standard commercial home mortgage to reorganize your payments. Refinancing will prolong your repayment term and aid decrease your current interest rate. Prepare for Higher Origination Charges Difficult cash car loans can bill a source charge between 1% to 3%.

If you're source charge is 3 percent as well as your finance is $850,000, your origination charge would certainly cost $25,500. Some lending institutions could not grant funding since of strict genuine estate compliance regulations.

Excitement About Hard Money Atlanta

If there are numerous complicated rules, they might transform down your application. Lastly, the greatest danger is losing your residential property. If you back-pedal your financing or stop working to re-finance early, hard money lending institutions can take your residential or commercial property and also sell it by themselves. Prior to taking this bargain, make certain you have enough funds to cover your bases.They might still make a great profit even if you fail on your financing. To touch tough money car loan companies, you can get in touch with real estate representatives and also genuine estate investor groups.

Report this wiki page